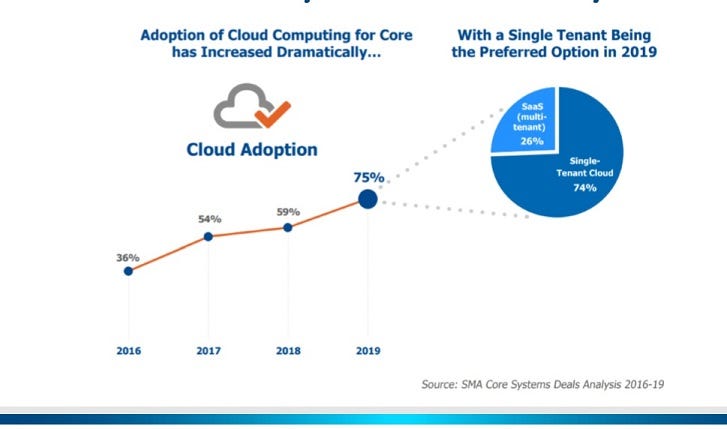

More P&C Insurers move core systems to the cloud

Across Top Market Tiers, To Single Tenant and SaaS

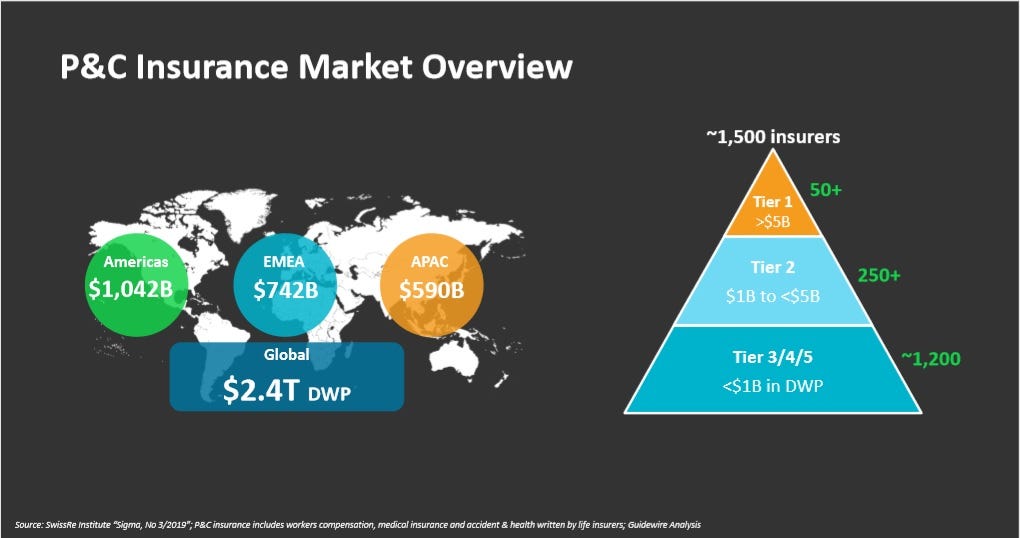

P&C Insurance market when divided into tiers, shows a Pareto like effect.

The top 3% of P&C companies worldwide (Tier 1 in chart below) account for 45% of $2.4 trillion Direct Written Premium (DWP). That is 50 of 1500 carriers.

The top 20% of companies globally (300 carriers) account for 75% of DWP.

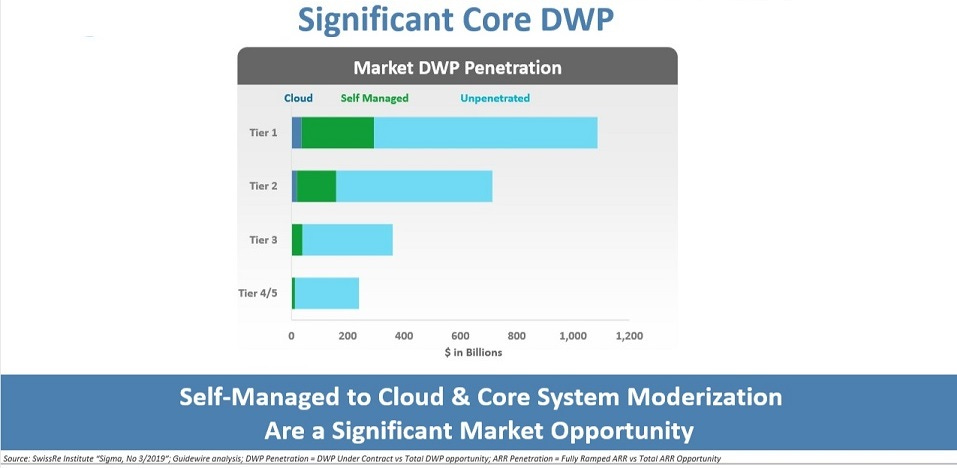

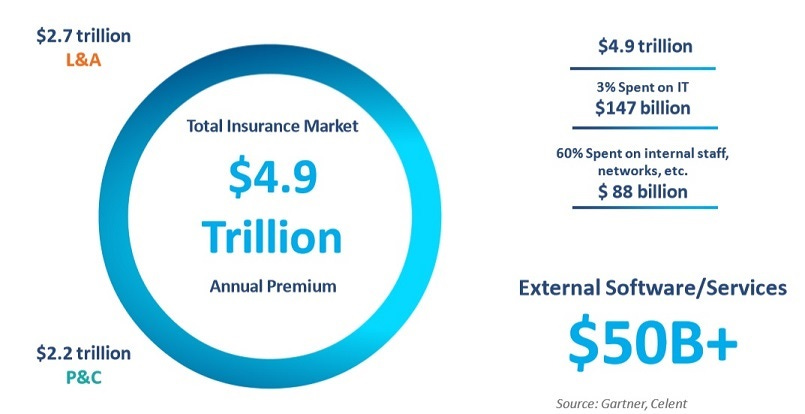

The market potential for core systems modernization in insurance and for migrating to the cloud is large. Dominant players price their products based on DWP of carriers.

The opportunity size for core insurance modernization exceeds $50 billion, much of which is unpenetrated. The gap based on DWP is depicted above.

While carriers are increasingly moving their core systems to the cloud, vendors are reporting higher mix of cloud subscription revenues and less of term license revenues, while improving margins. SaaS as a proportion of total cloud deployments is on the rise.

Guidewire is a leader in the North America Core Systems Market. Recently, Duck Creek which is a strong SaaS player, has announced plans for an IPO. Their S-1 document can be found here. Duck Creek cloud subscription revenues have increased from 40% to 60% in the last two years.

Majesco, another dominant core systems player, with increasing SaaS revenue, has been bought by PE investor Thoma Bravo. Do watch out for more updates on these core tech market players and movers.

#insurtech #cloud